Palmpay Loan: How to Borrow Money from Palmpay

Explore Palmpay Loan And How to Borrow Money from Palmpay Via Palmpay App. This post will guide you to Download Palmpay App, Sign Up and More Details On Palmpay Loan Code.

How to Borrow Money from Palmpay: PalmPay is a digital wallet and mobile money platform that allows users to send and receive money, pay bills, buy airtime and data, and shop online. It is available in Nigeria, Ghana, and other African countries.

PalmPay is not a bank, but it is licensed by the Central Bank of Nigeria to provide mobile money services. This means that it is a secure and reliable platform for financial transactions.

See Also: Loan App In Nigeria With Low Interest Rate | Top 20 Best Loan Apps

Features Of Palmpay

Here are some of the features of PalmPay:

- Send and receive money instantly and for free to any PalmPay user or Nigerian bank account.

- Pay bills for electricity, water, cable TV, and more.

- Buy airtime and data for yourself or others.

- Shop online at a variety of stores.

- Save money with high interest rates.

- Earn rewards for using PalmPay, such as cashback and discounts.

- Get access to exclusive offers and discounts.

PalmPay is a convenient and affordable way to manage your finances. It is a great option for people who want to avoid bank charges and who want to earn rewards for using their money.

Additional Information About Palmpay

Here are some additional information about PalmPay:

- It was founded in 2017 by Uche Pedro and Adetayo Ademola.

- It has over 10 million users in Nigeria and Ghana.

- It is backed by leading investors, such as Tiger Global Management and Accel Partners.

- It is one of the fastest-growing digital wallets in Africa.

If you are looking for a secure and convenient way to manage your finances, PalmPay is a great option. You can download the app from the Google Play Store or the App Store.

Read Also: List Of Fake Loan Apps In Nigeria To Avoid

About PalmPay App

Palmpay is a digital finance app with a digital wallet for money transfers, getting loans and bill payments.

Palmpay is licensed by the CBN as an MMO and its deposits is insured by the NDIC.

PalmPay loan is one of the fastest ways to borrow money in Nigeria, as you do not need a guarantor or any collateral.

Palmpay loans are instant and you can get it within 5 minutes of approval.

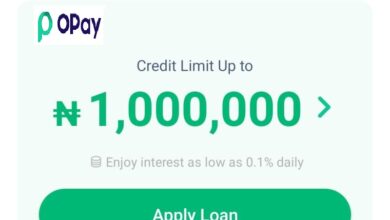

The minimum amount you can borrow from Palmpay is ₦10,000 while the maximum amount is ₦200,000.

How to Borrow Money From PalmPay

Here’s how to borrow money on Palmpay in Nigeria :

- Download the Palmpay app on your phone

- Then create an account by filling out the registration form with your information

- After successful registration, the app will take you to your Account dashboard.

- Then navigate to “Loans” and click it. You will be shown the amount you are eligible to borrow.

- Then just follow the instructions and if everything is in order you’ll get the loan disbursed to you by Palmpay.

PalmPay Loan Requirements

You should know that before you can apply for a Palmpay loan on the PalmPay app, you’ll need to meet certain criteria.

Here are the requirements you meet to have to borrow money from Palmpay:

- You must have a PalmPay Account before you can access loans.

- Valid Bank Account

- BVN

- Means of Identification (NIN, Int Passport, Drivers License, Voters Card)

- Utility Bill

- Be at least 22 years old

- Your credit score must be good and you must not have any pending loans to repay.

Download Palmpay App

You can download the PalmPay app from the Google Play Store or the App Store. Here are the links:

- For Android, Click Here To Download Palmpay On Google Play Store

- For iPhone, Click Here To Download Palmpay On App Store

Once you have downloaded the app, you can open it and create an account. You will need to provide your phone number, name, and date of birth. You will also need to verify your phone number by entering a code that will be sent to you.

Once your account is created, you can start using PalmPay to send and receive money, pay bills, buy airtime and data, and shop online.

Palmpay Sign Up / Registration

Here are some of the steps on how to download the PalmPay app:

- Open the Google Play Store or the App Store on your device.

- Search for “PalmPay”.

- Tap on the “Install” button.

- Once the app is installed, open it.

- Tap on the “Create an Account” button.

- Enter your phone number, name, and date of birth.

- Tap on the “Verify” button.

- Enter the code that was sent to your phone.

- Tap on the “Sign Up” button.

- You have now successfully created a PalmPay account.

Palmpay USSD Code (Palmpay Code)

The PalmPay USSD code is *652#. You can use this code to check your balance, send and receive money, pay bills, buy airtime and data, and more.

Here are some of the things you can do with the PalmPay USSD code:

- Check your balance: Dial *652# and press 1.

- Send money: Dial *652# and press 2. Enter the phone number of the recipient, the amount you want to send, and your PalmPay PIN.

- Receive money: Dial *652# and press 3. Enter your PalmPay PIN.

- Pay bills: Dial *652# and press 4. Select the bill you want to pay and enter the amount.

- Buy airtime and data: Dial *652# and press 5. Select the network you want to buy airtime or data from and enter the amount.

- Save money: Dial *652# and press 6. Enter the amount you want to save and your PalmPay PIN.

- Earn rewards: Dial *652# and press 7. Learn about the different ways you can earn rewards with PalmPay.

- Get help: Dial *652# and press 8. Speak to a PalmPay customer representative.

See Also: Best Ways to Make Money Online In Nigeria | Top 20 Ways To Earn

FAQs Regarding How To Borrow Money From Palmpay

who is the owner of palmpay

It was founded in 2017 by Uche Pedro and Adetayo Ademola.

How much Loan Can You get from PalmPay?

You can get a loan of up to N200,000 from PalmPay without any paperwork or collateral.

PalmPay Loan Interest Rate

Depending on your credit score, and the loan amount you want, the interest rate can range between 15% to 30%.

Palmpay charges a high-interest rate and gives a short repayment period for first-time borrowers. However, as you continue to borrow and repay on time, rates and loan terms will be better.

Palmpay Loan Repayment Period?

The loan repayment period on PalmPay is between 1 month to 1 year.

How can I Repay my Loan on PalmPay?

To repay your loan on PalmPay, follow the steps below:

1. Login into your Palmpay account.

2. Next, go to the dashboard and look for the “loan repayment” tab.

3. Then,Click on the tab and select your medium of repayment. You can choose either a Bank transfer or an ATM.

What Happens if I default on my Loan?

If you fail to pay back your loan on time, PalmPay will increase your interest by 20%. Over time, if you still don’t repay the loan, PalmPay will send your name and details to the Credit Bureau to blacklist. Blacklisting makes you unable to borrow a loan in Nigeria until you pay back the loan.

See Also: Opay USSD Code – Opay Transfer Code And How To Use It

Palmpay Contact

How can I contact PalmPay?

You can contact PalmPay through the following ways:

Email: support@palmpay.comPhone Number: 018886888 Website: www.palmpay.com

palmpay customer care number and Email

Email: support@palmpay.com

Phone Number: 018886888

Website: www.palmpay.com

Conclusion

That’s all about How to Borrow Money from Palmpay without stress. I hope this article was helpful to you? If you have any question regarding this, kindly use the comment box below or simply contact Palmpay via contact details provided here above.

Kindly Share This Post: If you think this post can be helpful to somebody else, please share it using the buttons below!!!